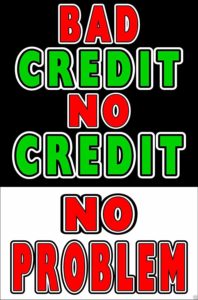

You’ve seen signs like this one, soliciting business from people who can’t, or won’t, pay their bills. Have you ever wondered how a business stays in business doing business with people who have a history of not paying what they owe?

You’ve seen signs like this one, soliciting business from people who can’t, or won’t, pay their bills. Have you ever wondered how a business stays in business doing business with people who have a history of not paying what they owe?

Me too. So, one day, when I got the chance, I asked.

I was a newspaper reporter, working a story in Lumberton, N.C., the county seat of Robeson County, a county whose residents know too much about poverty. The median family income in Robeson is the lowest among North Carolina’s 100 counties, according to the last census.

One of the men I needed to talk to happened to own a used car lot and he agreed to meet me there. A big sign on the front of the lot welcomed customers with bad credit.

I got there a few minutes early so I parked and walked around the lot, looking over the merchandise.

Right off I noticed those cars were not like mine. My car, a white, boxy, four-door, used to belong to the state. I bought it at auction from the State Surplus Property Office. The cars on the lot were all newer, sportier — and had two doors.

It was really hot that day so I decided to wait in the air-conditioned office, a one-room building with tinted windows, the kind that allowed the salesman to see out, see what what you were doing, but didn’t allow you to see in.

The salesman offered me a chair and we got to talking and I asked him why he didn’t have any four-door cars for sale.

He told me his customers were mainly high school boys and servicemen, and they wouldn’t buy a four-door. Family cars, he called them.

And then I asked him the question you might have wondered about yourself: How do you make money doing business with people who have a reputation for not paying their bills?

This is what he told, pretty much word for word:

“We get what we paid for the car in the down payment and we finance the rest at 36 percent. If they don’t pay we repossess the car and sell it again.”

Coming Monday: The Sermon I’ve Never Forgotten